This goes without saying, but the first thing everyone thinks about when they hear about people who travel for a living is: how do they afford it?

And I don’t blame them! It’s the biggest question I have when I’m getting major wanderlust from someone’s travel photos. How could they afford to go there? How did they pay for the flights?

Well, it’s not as unrealistic as you think to plan an extended trip abroad. It might not be ideal to jump on a plane tomorrow — but what’s stopping you from going next year?

Read on for how we took the leap and bought ourselves a one-way ticket to Europe, and how you can start traveling too:

1. Budget in advance.

I’m a stickler when it comes to saving. I actually get a rush from NOT spending money (if anyone else feels this way, time to befriend me in the comments below). It’s because whether I acknowledged it or not, every dollar I saved I knew I could put towards a travel experience. So, here’s what I did before that sweet sweet paycheck hit my bank account:

- I calculated how much I should spend in a typical month. $900 for rent, $300 for groceries, $150 for gas…you get the idea.

- I summed up all those expenses and noted that as my typical monthly spend. Let’s say that number is $2,000 (try to give yourself a bit of a cushion), and each month you receive $2,300 from work.

- On the 1st of each month, I put $2,000 in my checking account. No more, no less.

- During the month, I chose something simple to cut back on: drinks. Whether it was opting for water when dining out, or using my coffee machine at home, I didn’t waste money on beverages: alcoholic or otherwise.

- I checked in mid-month and 1 week from the end. Was I on track to spend less than my budget? Usually, yes!

- At the end of the month, I logged into my account and moved my leftover cash to my travel savings account, feeling super accomplished. Let’s say my leftover was $100: it doesn’t seem like much — but I also didn’t spend the extra $300 I received from my paychecks! An extra $400/month to put towards travel adds up quick.

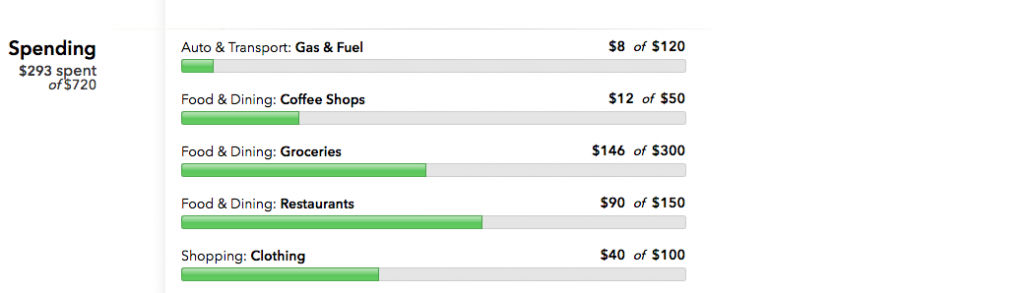

To track your expenses, I’d recommend the Mint App. It’s easy to understand and access from your smartphone, and helps you work towards a savings goal quicker than ever.

2. Get a credit card with travel rewards.

Most have no monthly fee, and the rewards are super useful. I use the CapitalOne rewards card which gives me points for every dollar spent, and can be used towards hotels and flights (my only regret is waiting so long to apply — on an impulse late one evening, it took me 20 minutes to apply and 1 week to get my card!). I wanted something that would work internationally and wouldn’t restrict me to a specific airline. Jacob, on the other hand, flies American Airlines for work and signed up for an AAdvantage card to gain more miles and airline perks. Do some research first to figure out what card is right for you.

3. Tap into your network.

This will definitely not be the case for everyone, but we were lucky enough to not pay rent the last 3 months before we left. That’s because we waited until our leases were over, gathered our belongings, and moved in to Jacob’s family’s house. I downloaded some podcasts, signed up for Spotify, and commuted to work in L.A. every day. In the end, those 3 months of saving rent money felt like a 2 month cushion for traveling.

If you don’t have close family nearby, get creative! Do you have a friend or a family friend who wouldn’t mind hosting you for a few weeks? Does your old university offer short-term housing? You could even look into an extended stay with Airbnb — some hosts offer up to a 60% discount when you book a month or more, especially in the off season. Here’s $40 off if you’ve never used Airbnb before.

4. Sell things you don’t need.

It’s hard parting with your possessions. I’ll be the first to admit it — I can’t tell you how many times I’ve dubbed a 5-yr-old t-shirt my next “work out” or “relaxing at home” shirt. But the reality is, it feels good to let go! I bought the book The Life-Changing Magic of Tidying Up for inspiration, called over some friends for support, and dedicated a couple weekends to gutting my apartment. Which brings me to my next point…sell anything you can.

You don’t need the furniture, the extra clothes you haven’t worn for over a year, or the books you never open anymore. Jacob and I hosted a garage sale that made us some serious $$ in one day, and the remaining items we sold a few weeks before we left using smartphone apps like Poshmark (great for the fashionistas out there) and OfferUp (easy to use for selling furniture). For someone who can’t get on board the eBay train (me), these apps were gold.

5. Set money goals for your travels.

Once you’ve dedicated a few months to saving and have funds you are comfortable with in your bank account, it’s time to budget out your trip. Here’s how we did that:

- Calculated our combined rent cost.

- Divided that number by 30 (for avg days in a month).

- Looked for places to stay that were under that daily rate.

Our average nightly spend for 2+ months of traveling was $43/night. That’s $1,290/month — way less than our monthly rent in L.A. We spent more in places that we wanted to splurge at (Santorini), and less in places where we just wanted a basic room (Slovenia). A couple tips:

– when you’re booking via Airbnb, like we did, something to keep in mind is that their cleaning fees and taxes can add up. Staying 5 nights somewhere will save you money in the long run, vs. spending 2 nights there.

– we use Booking.com because it often has the best deals. I check most places out on Tripadvisor too before booking.

6. Be thrifty before leaving, but be smart.

Got some extra cash for your birthday, tax return, or rent deposit? Save it. Want to purchase your flight abroad? Use a flight tracker app like Hopper to watch for when prices drop, so you can buy when the timing’s right. Want to budget even more? Don’t forget to sign up for a travel credit card! DON’T cut corners on a safe place to stay for a night while traveling, or be ultra-thrifty with what you eat (that’s half the experience!). You’ll thank us later.

Keep in mind, there are endless reasons to travel — if you’re waiting for the perfect time, consider this as a sign to go for it and just pick a date. 😉

—

Real talk — what’s keeping you from traveling? Let me know in the comments below.

mynordicroom Says

Good Nice knowledge gaining articleh ttps://mynordicroom.com. This post is really the best on this valuable topic.

Thomas Says

Hi Selena,

During reading all these posts here , there is one open question to me.

What about a travel insurance worldwide ? And how much it takes from your budget. I look for a insurance that covers not only where I have my job , instead for travelers go around the world for one or even more years. When somebody reading this let me know some addresses. I am 49 and you older you get as more expensive is it to get or net get an insurance.

Thx

Selena Says

Post authorHi Thomas – this is tough to answer because each situation is different and it’s really based on personal preference for what you need and how much coverage you want. Sorry I can’t be more help, it’s not my expertise. 😉

Kate Says

My husband and I have just decided that in one year, we’re going to go live abroad for 1.5 years. It’s been a lifelong dream of mine, and he would love to see more of the world, too. Newly married, no kids, so why the heck not? Now comes the fun (hard!) part of figuring out the logistics of how to make a living and what sort of documentation we do (or do not) need. Anyway, I just wanted to drop a line and say thanks for all of the tips I’ve taken away from your blog over the last hour – and for all of the future tips, as well. Happy Travels!

Selena Says

Post authorHi Kate – i’m so glad you left a comment! Setting a date was one of the harder things we had to do but looking back, the best decision. We had the exact same thought process, so you’re in for one amazing adventure. 🙂

If there’s anything you’d want me to write about that you’re having trouble finding online — let me know! Always love to hear feedback, especially during such an exciting and critical time in the process. xx

Zeinab Says

Thank you so much for sharing this with us!

Saving is very important in general I believe, so you don’t have any source on income while traveling? you just spend from savings?

Selena Says

Post authorHi Zeinab! This post was written when we did a 3-month road trip through Europe. Now we work as bloggers and photographers.

If you are traveling temporarily, having a fund dedicated to your travels is a great way to start. I’d always recommend budgeting properly to ensure you have a cushion, and having an idea of how long you plan to travel and what you plan to do for work after. Whether that’s going back to where you started, settling somewhere new, or pursuing a new line of work in the travel industry or otherwise. 🙂

Alexandra Says

Hi Selena, I stumbled across your instagram account and now see your blog is up and running. You and your significant other are quite an inspiration for me and my travels. I am curious, what is the budgeting app that you have posted above? It looks very user friendly! Thanks for your time!

- Selena Says

Post authorThank you Alexandra! It’s the Mint App. It’s really useful for budgeting and keeping track of expenses!

Mauri Zingarelli Says

So many helpful tips, Selena ????

I’m traveling for the whole month of November and feeling very behind in the savings department, but your idea of cutting back on just one or two things per month is really inspiring. I know I can make a lot of headway in 2.5 months (and luckily I’m going to India where you can get a lot of bang for your buck). But the trick about a long-but-not-too-long trip is being able to still pay rent in the states ????

Talk to you soon and hopefully we can rendezvous in Amsterdam at the end of November. Xoxo

- Selena Says

Post authorGlad you find them helpful! It’s always hard to cut things out at first, but I am always anxious to see what a difference it can make in my bank account — and that reward of knowing I can put the money towards something new while traveling is worth it.

Can’t wait to see your India pics!

Bev (@bdholm) Says

These are great tips! My closets are busting at the seams currently (we recently added a baby to the mix and my goodness those baby gadgets add up quickly)! I can’t wait to do a purge of my old clothes and get back on track for traveling next year with our new family member! Sometimes I have to remind myself of the importance of experiences over possessions.

- Selena Says

Post authorCONGRATULATIONS on the new baby! Yes, it’s amazing how the clutter can add up quickly…even without a new member of the family. 🙂 Glad you liked the tips. Enjoy the adventures the next year will bring and let us know when you start planning a new trip!

P.S. I hear Sweden is THE place to bring children. Haven’t been myself, but it’s on our list!